From IRS Issue ( Issue Number: IR-2018-135) about June 15 Deadline for those who were away/out of the country during the April 15th deadline. More information on the tax rules that apply to U.S. citizens and resident aliens living abroad can be found in Publication 54,

IRS reminds taxpayers who are living and working outside the United States that the deadline to file their 2017 federal income tax return is Friday, June 15. The special deadline is available to both U.S. citizens and resident aliens abroad, including those with dual citizenship. An extension of time is available for those who cannot meet the June 15 deadline.

The Internal Revenue Service today reminded taxpayers living and working out of the country that they must file their 2017 federal income tax return by Friday, June 15.

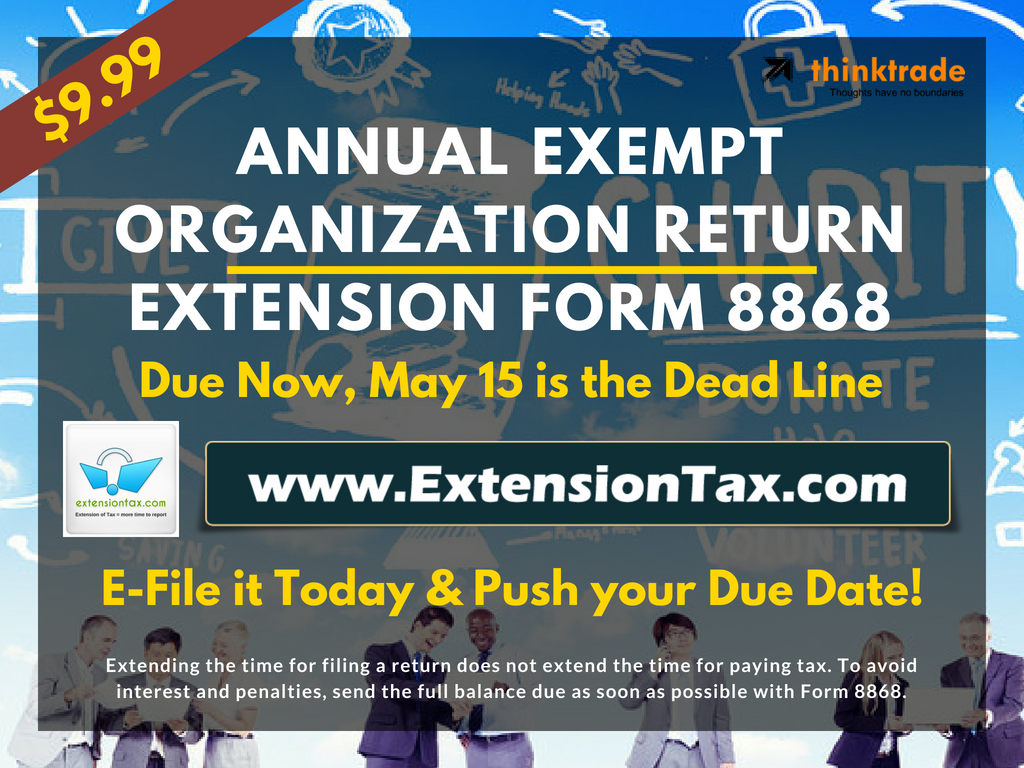

The special June 15 deadline is available to both U.S. citizens and resident aliens abroad, including those with dual citizenship. An extension of time is available for those who cannot meet it.

Some key points to keep in mind: Continue reading